Overview

Yantra GST SuiteApp helps businesses in India manage their operations, reporting, and compliance pertaining to the applicable Goods and Services Tax (GST), and TDS requirements.

GST bundle extends NetSuite to address the multiple nuances of GST computation and reporting with GSTR2A reconciliation.

Highlights

- Automated determination of the GST type

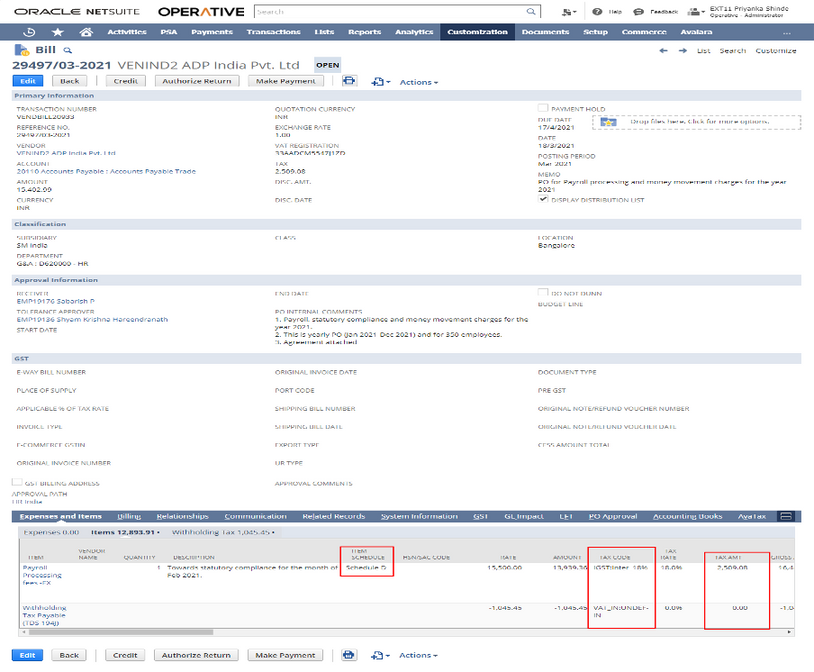

- Manage local GST and TDS tax requirements

- Handling GST impacts for SEZ sales & export sales, and TDS

- E-Invoice integration

- E-Way bill integration

- Creating localized reports

Benefits

- Ensure Tax Compliance with statutory reporting & error-free configurations and documentation.

- Gain Control With Automated rules Management & correctly configure corresponding GST and handle SEZ sales, export sales, and unregistered Customers (B2C).

- Enable timely and accurate reporting by tight integration with business systems, processes and workflows, and ensure tax calculations accuracy and better tax accounting control.

Features

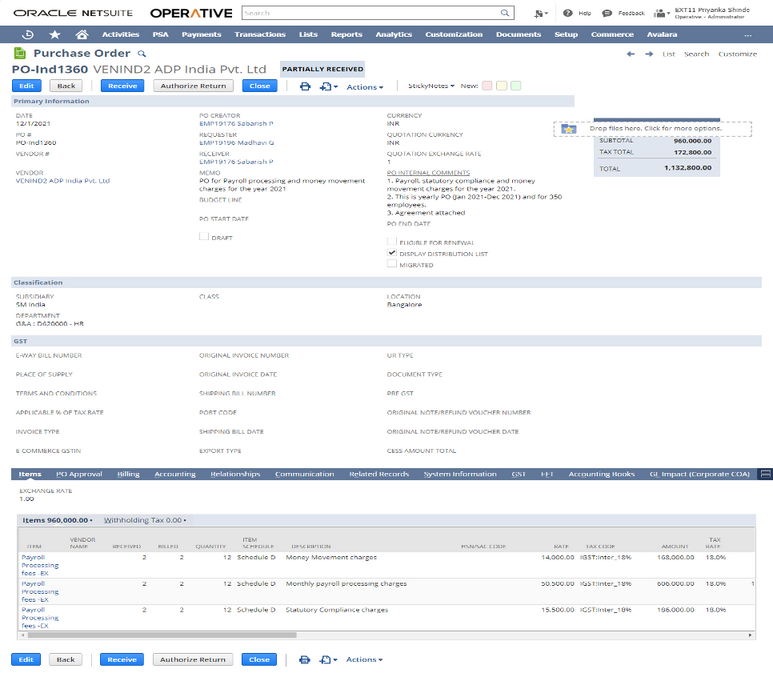

- Create tax records for India GST calculation with tax codes (HSN/SAC) and types (CGST, SGST, IGST)

- Calculates GST while processing sales and purchase transactions.

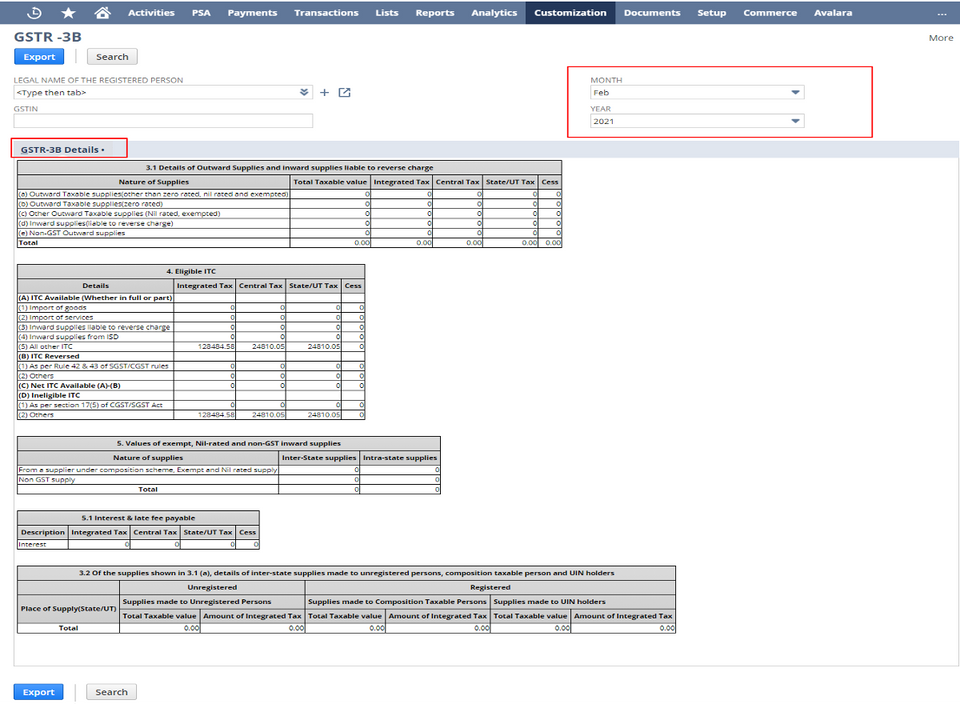

- Ensure compliance by preparing GST tax details for return filing, submissions to tax authorities, and utilization of input tax credits.

- Support export/import of goods and services under GST regulations, including SEZ and unregistered customers (B2C).

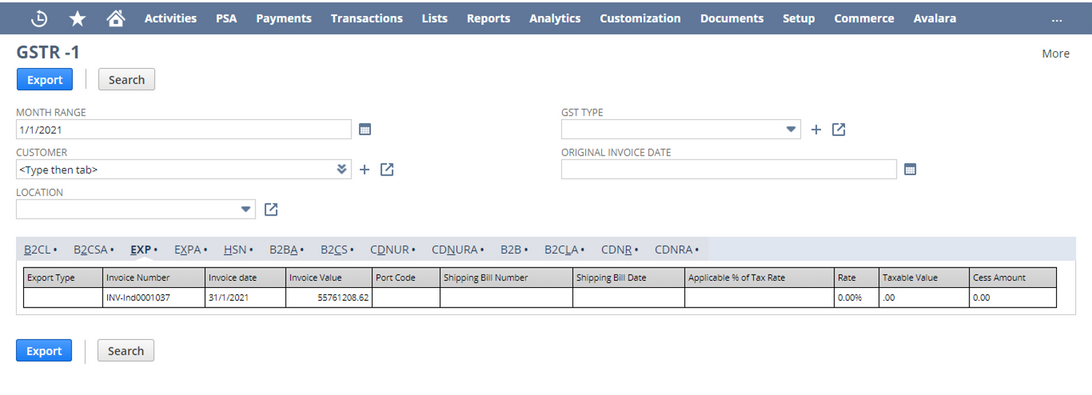

- Statutory reporting and ability to create statutory adjustment journal.

- Invoicing ready with a built-in connector for integrating with leading GSP – Cygnet Infotech & Cleartax GSP

*Cygnet Infotech or Cleartax – GSP Services should be availed separately from data and NetSuite.